HBL issues its schedule of charges twice a year covering all retail banking fees including account services, debit cards, ATMs, IBFT transfers, POS transactions, international usage, SMS alerts and digital banking. This pricing structure is published under State Bank of Pakistan requirements to keep customers informed.

Debit Card Fees Annual Issuance Renewal

HBL offers a wide range of debit cards under PayPak, Visa, MasterCard, UnionPay and Islamic categories. Annual charges for 2025 are listed below (all amounts in PKR unless stated).

- Konnect PayPak Debit Card – 2,000 per year (first year free for certain payroll packages)

- Visa Classic (HBL Classic) – 2,500

- MasterCard Standard (Platinum) – 2,800

- MasterCard Gold – 3,600

- MasterCard Titanium – 3,000

- MasterCard World Elite (Prestige) – 20,000

- UnionPay Card – 550

Other options include:

- Agent or Mobile Banking Debit Card – 1,100

- Konnect Digital Wallet Debit Card – 1,500

- HBL Youth Debit Card – 1,500 (first year free)

- HBL SCO Debit Card – 1,500

- HBL Islamic Debit Cards – around 3,000 for Visa or MasterCard, 2,000 for PayPak

Supplementary cards usually carry lower charges (e.g. PayPak nil, Visa or MasterCard 550, Titanium 900). Several account categories offer first year waivers including Roshan Digital and Islamic Nisa.

Ad

Replacement and PIN Fees

- Lost or expired card reissuance – 500 to 1,000 depending on type

- UnionPay reissuance – 700

- USD card replacement – 4 USD

- PIN reset at branch or PhoneBanking – 500

- No fee for adding a card to Google Pay or Apple Pay

ATM Withdrawal and Balance Inquiry

- HBL ATMs – Free for all withdrawals and balance checks

- Other Bank ATMs within Pakistan – 23.44 per withdrawal, 3.13 per balance inquiry (exemptions for Freedom and Haryali if minimum balance is maintained)

- International ATMs – 4% of withdrawal amount with a minimum of 300, balance inquiry abroad 225 or 1 USD for foreign currency accounts

Interbank Funds Transfer

- HBL to HBL transfers – Free up to 25,000 per day. Above this, 0.1% of amount capped at 500

- HBL to other banks – Free up to 25,000. Above this, 0.1% of amount (minimum 25, maximum 200)

- Bill payments, mobile top-ups, education fee payments – Free

POS and International Usage

- Domestic POS transactions – Free for all HBL debit cards except Visa Classic which is charged at 1% of amount

- International POS purchases – 4% of transaction amount (currency conversion included)

- Cross border internet transactions – OTP secured with 4% conversion charge

SMS Alerts and Digital Services

- Transaction SMS alerts are free for most accounts

- Monthly fee of 225 applies for over the counter SMS alerts if subscribed

- Freedom and Haryali account holders are exempt from SMS charges

- HBL Mobile and Internet Banking services are free including fund transfers, bill payments and device registration

Benefits of HBL Debit Cards

- Global acceptance on Visa, MasterCard and UnionPay networks

- Rewards and cashback programs with merchant discounts through HBL Deals platform

- Contactless payment support and compatibility with Google Pay and Apple Pay

- Premium cards such as HBL World Debit provide airport lounge access, higher withdrawal and spending limits, travel insurance and lifestyle privileges

Ad

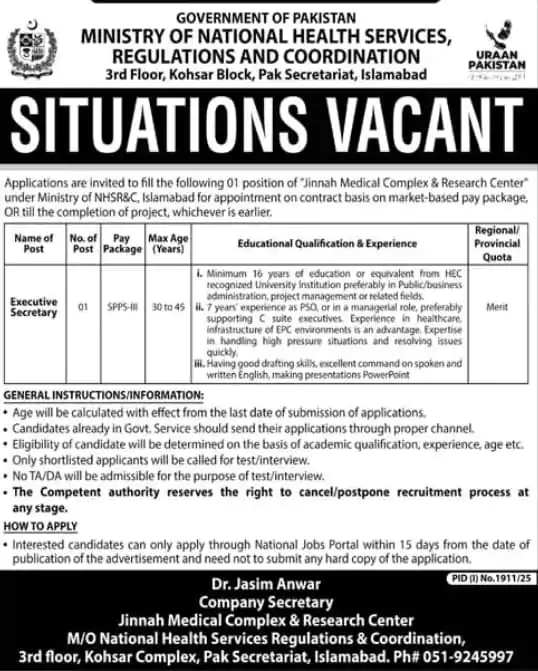

How to Apply:

You can request a debit card through multiple channels

- HBL Branch – Visit any branch, fill account opening form or additional request form, submit documents

- HBL Mobile App or Internet Banking – Log in, go to Cards section and select Request New Debit Card

- HBL Website – Visit hbl.com/personal/cards to view options and apply

Requirements

- Valid CNIC or passport

- For minors, birth certificate and parent or guardian CNIC

- Proof of address such as utility bill or bank statement

- Proof of income such as salary slip or certificate (for students or minors, guardian’s proof)

- Completed account forms and recent photographs if not on record

Card Activation and Usage

To activate a new card, send SMS:

DC<last4digits> (example: DC4321) → 14250

You will receive an activation code. Then visit an HBL ATM, insert the card and follow instructions to set your PIN.

Through HBL Mobile App, customers can manage cards including activation, PIN change, international usage enable/disable, limit changes, blocking or requesting replacement.

All HBL debit cards are enabled for international transactions and are protected with 3D Secure OTP for online purchases.

For full details visit official site: hbl.com

Leave a Comment